Greater Seattle’s Life Science Industry 2024 Report

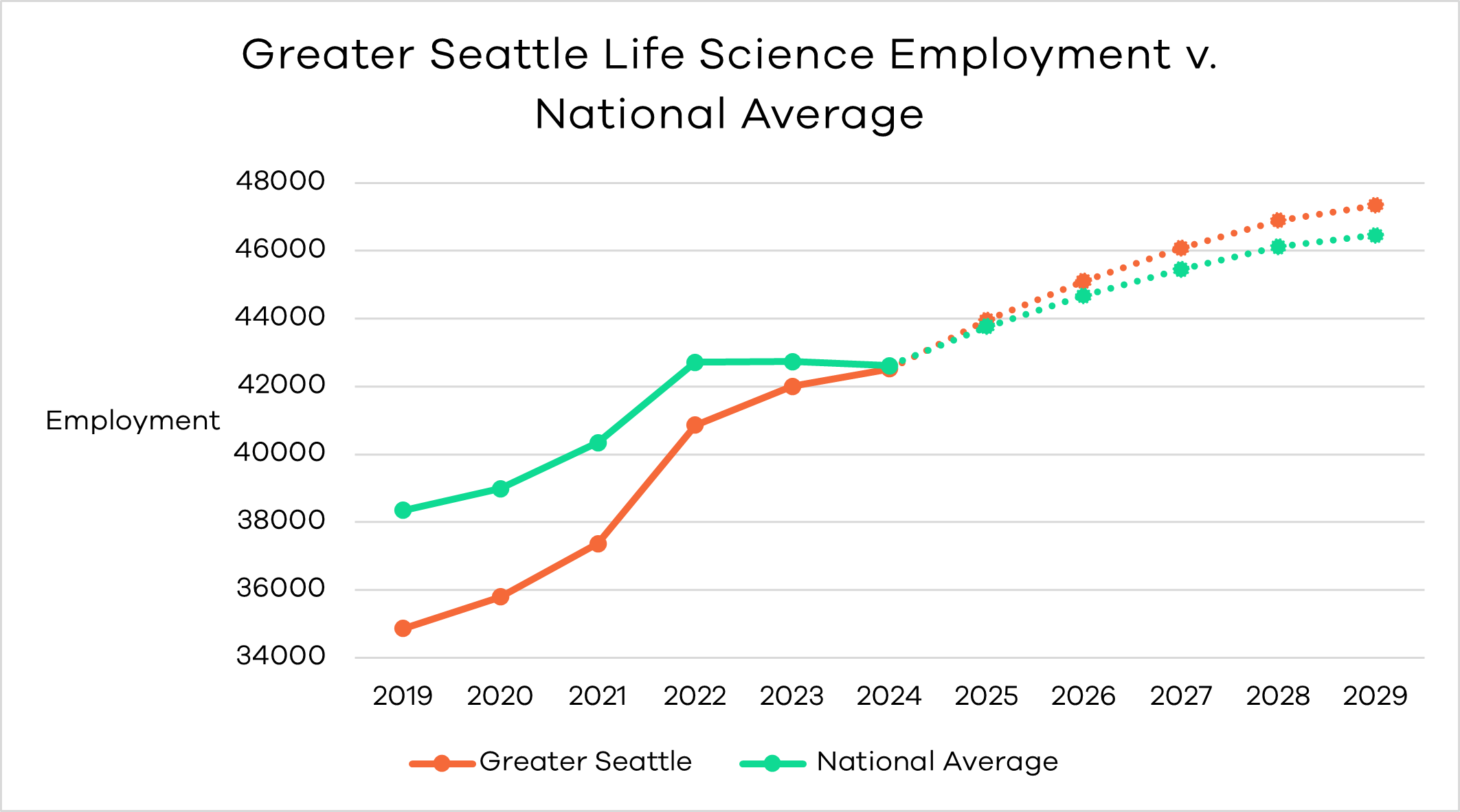

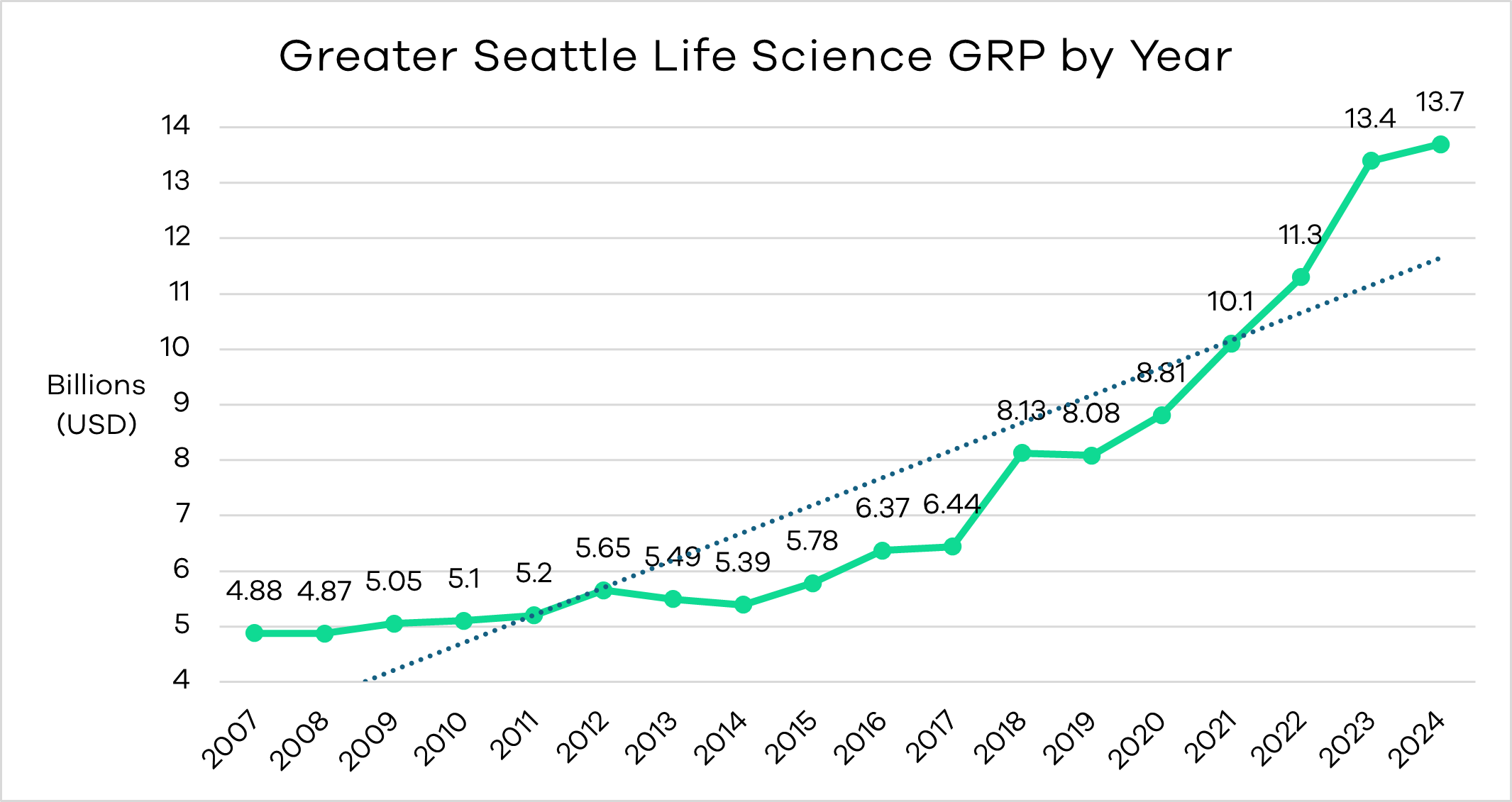

Greater Seattle’s life science industry ranks among the top clusters in the U.S., supporting over 42,500 jobs and contributing $13.7 billion to the region’s GRP in 2024. The average earnings per job in this sector are $192,398. Additionally, 47.7% of these jobs are held by women. From 2019 to 2024, the industry experienced a growth rate of 22%, and it is projected to grow by an additional 11% from 2024 to 2029. This impressive performance along with 9.3 million square feet of lab and research and development space (Colliers, 2023) in the region has helped to position Greater Seattle in the top 10 life science clusters in the U.S.

| 42,500+ Jobs | $13.7B Total GRP (2024) | $192,398 earnings per job |

| 22% growth from 2019-2024 | 11% projected growth from 2024-2029 | Top 10 life science cluster in the U.S. |

The largest biotech companies in the region, by local employment, are Pfizer (1,500 employees), Bristol Myers Squibb (1,295 employees), Just-Evotec Biologics (408 employees), AGC Biologics (400 employees), and Adaptive Biotechnologies (378 employees), the latter three of which are headquartered in the region.

Top 5 Largest Biotech Companies in Greater Seattle

| Company | Location | Local Employment | Companywide Employment | Headquarters |

| Pfizer | Bothell | 1,500 | 81,000 | New York City |

| Bristol Myers Squibb | Seattle | 1,295 | 30,000 | Princeton, NJ |

| Just-Evotec Biologics | Seattle | 408 | 5,000 | Seattle |

| AGC Biologics | Bothell | 400 | 2,500 | Bothell |

| Adaptive Biotechnologies | Seattle | 378 | 650 | Seattle |

Greater Seattle’s life science GRP has steadily increased from 2007 to 2021, from $4.88 billion in 2007, to $10.1 billion in 2021. In the last three years from 2021-2024 we have seen greater than average growth in GRP, reaching $13.7 billion in 2024. Life science employment in the region has also been steadily increasing, albeit with a tapering off between 2022-2024. Employment is projected to grow faster than the national average from 2025-2029.

Of the 148 life science startups that were launched in the last 10 years, nine made acquisitions, eleven were acquired, and two both made acquisitions and were acquired. Seven companies are public, two are delisted, and 138 are private. Companies with the most funding are Sana Biotechnology, Alpine Immune Sciences, Umoja Biopharma, Viome, 98point6, Eliem Therapeutics, Perspective Therapeutics, ProfoundBio, Icosavax, Silverback Therapeutics, respectively.

| Rank | Organization Name | Total Funding Amount (in USD) | IPO Status | Founded Date | Industries |

| 1 | Sana Biotechnology | $865,000,000 | Public | 2018 | Biotechnology, Health Care, Life Science, Product Research |

| 2 | Alpine Immune Sciences | $475,300,000 | Delisted | 2015 | Biotechnology, Health Care, Medical |

| 3 | Umoja Biopharma | $363,000,000 | Private | 2019 | Biopharma, Biotechnology, Developer Platform |

| 4 | Viome | $301,004,496 | Private | 2016 | Dietary Supplements, Health Care, Medical, Wellness |

| 5 | 98point6 | $299,300,000 | Private | 2015 | Health Care, Health Diagnostics, Medical, mHealth, Mobile Apps |

| 6 | Eliem Therapeutics | $291,302,493 | Public | 2018 | Biotechnology, Health Care, Pharmaceutical |

| 7 | Perspective Therapeutics | $257,600,000 | Public | 2022 | Health Care, Medical, Therapeutics |

| 8 | ProfoundBio | $247,000,000 | Private | 2018 | Biotechnology, Oncology, Therapeutics |

| 9 | Icosavax | $235,300,000 | Delisted | 2017 | Biotechnology, Health Care, Pharmaceutical |

| 10 | Silverback Therapeutics | $221,000,000 | Public | 2016 | Biopharma, Biotechnology, Health Care, Medical, Therapeutics |

| 11 | Outpace Bio | $199,000,000 | Private | 2020 | Biotechnology, Health Care, Life Science, Pharmaceutical |

| 12 | Kestra Medical Technologies, Inc. | $196,000,000 | Public | 2014 | Health Care, Health Diagnostics, Medical Device |

| 13 | Curevo | $196,000,000 | Private | 2018 | Biopharma, Biotechnology, Health Care, Medical |

| 14 | EchoNous | $194,000,000 | Private | 2015 | Artificial Intelligence (AI), Health Care, Medical, Medical Device |

| 15 | GentiBio | $177,000,000 | Private | 2020 | Biotechnology, Life Science |

| 16 | Shape Therapeutics | $147,500,000 | Private | 2018 | Biotechnology |

| 17 | Faraday Pharmaceuticals | $140,826,124 | Private | 2014 | Biotechnology, Pharmaceutical, Therapeutics |

| 18 | OncoResponse | $130,100,000 | Private | 2016 | Biopharma, Biotechnology, Health Care, Oncology, Therapeutics |

| 19 | Variant Bio | $129,700,000 | Private | 2018 | Biotechnology, Genetics, Medical, Therapeutics |

| 20 | LifeStance Health | $125,000,000 | Public | 2017 | Health Care, Hospital, Medical |

Sources: Crunchbase, 2025; Lightcast, 2025; Puget Sound Business Journal Book of Lists, 2025.

The report was researched and written by Dr. Victoria DePalma, Greater Seattle Partners Research Director.

Other 2024 Greater Seattle Reports:

Greater Seattle Economic Report 2024

Greater Seattle 2024 Trade

Greater Seattle 2024 Foreign Direct Investment

Greater Seattle Startups 2024 Report

Greater Seattle’s Aerospace Industry 2024 Report

Greater Seattle’s Tech Industry 2024 Report

Ready to take advantage of everything Greater Seattle has to offer?